We're approaching the last day of the month which will occur midweek and hence bullish odds are enhanced. This week's Ponzo updates look very similar to last week's....strong bullish momentum for SPY and narrow range consolidation for TLT.

Yahoo data issues are still not resolved for the Mosaic models. I've been in touch with 6 different user groups that have been blindsided by the Yahoo issue and bottom line appears to be no more free data (no more free reliable data) and the cheapest option so far appears to be esignal real time at $55/month.

Tuesday, May 30, 2017

Monday, May 22, 2017

SPY and TLT Ponzo Updates...05.22.17

The YAHOO data stream remains DOA but we are still able to update the Ponzo forecasts on a limited basis. As such, here are SPY and TLT....SPY suggesting a bullish momentum while TLT looks to be hunkering down to a narrow range low volatility scenario.....with the usual caveats in both cases that surprise geopolitical news could quickly derail any market momentum or stability.

Wednesday, May 17, 2017

ON HOLD......05.17.17

As part of the AOL+YHOO= OATH merger Yahoo has terminated the data strings (EOD and RT) that provided input to Ponzo, VDX and the M series models. As a result ,we are currently unable to update any of our toolbox until this issue is resolved. No advance notice was provided of the termination, leaving us in a scramble mode. We're currently exploring new data provider options as it appears the new OATH strings will make updating our multi-input models problematic.

For now we're looking for an IT consultant who can facilitate the new data stream.

Mosaic users will be advised when we once again become operational.

For now we're looking for an IT consultant who can facilitate the new data stream.

Mosaic users will be advised when we once again become operational.

Monday, May 15, 2017

M6 Tuesday Forecasts......05.15.17

Despite all the economic and geopolitical risk factors that continue to fester the markets managed

to confound short sellers as SPY blasted through 240 and most of the indices registered new highs.

It was a low volume run up but the A/D line was strong and solid. Now we await Turnaround Tuesday to see if we get a follow through or pullback.

Meanwhile our World model continues to bank better gains than the US market model and .....heads up......both models have STOP Alerts turning down thereby warranting caution (EWZ is stopped).

to confound short sellers as SPY blasted through 240 and most of the indices registered new highs.

It was a low volume run up but the A/D line was strong and solid. Now we await Turnaround Tuesday to see if we get a follow through or pullback.

Meanwhile our World model continues to bank better gains than the US market model and .....heads up......both models have STOP Alerts turning down thereby warranting caution (EWZ is stopped).

Sunday, May 14, 2017

M6 World Outlook, VDX Updates and More...05.14.17

The updated M6 World model has generated great returns recently, led by EWZ (Brazil). For now this is our go to portfolio as the domestic M6 Market model is stuck in a churn and burn (commissions) mode. While US market momentum may have stalled the international markets appear to be in a rally mode so as long as stops are respected that looks like the better odds situation.

Trader's Outlook is bearish to neutral next week as we hit mid month and the Sell in May crowd has yet to decide whether to quit the game (bad choice last year) or hang in there.

The VDX updates have us in a potential mean reversion setup for a pop in SPY and a drop in TLT although it looks technically premature..

Trader's Outlook is bearish to neutral next week as we hit mid month and the Sell in May crowd has yet to decide whether to quit the game (bad choice last year) or hang in there.

The VDX updates have us in a potential mean reversion setup for a pop in SPY and a drop in TLT although it looks technically premature..

Thursday, May 11, 2017

M6 Market Outlook for Friday....05.11.17

The M6 Market model remains in a STOPPED mode. The M6 WORLD model is a bit more optimistic as we move into a likely Friday sell down. Earnings are winding down, mostly with upside results (except retail) and we're currently on Alert for the next big news.....little of which recent news has had much of a negative effect on momentum.

Wednesday, May 10, 2017

M6 Market Outlook for Thursday....-5.10.17

The M6 Market model is signalling vested positions for QQQ in momentum and AGG in mean reversion, basically leaving us with a net neutral outlook. As the US equity markets continue to frequently confound technical analysis I'm looking for alternate investment venues and in that light here's a look at a variation of the old World model, featuring just 6 ETFs the World covers the the SPY, the European largest 900 companies (EFA), global emerging markets (EEM), Russia (RSX), Brazil (EWZ) and China's nifty fifty (FXI). We're still playing with relative beta to establish appropriate limit stops but for now we're just using a 1% across the board baseline.

Tuesday, May 9, 2017

M6 Market Outlook for Wednesday...05.09.17

As the markets go nowhere on low volume and with low volatility the current M6 signals are both in Stopped mode. For now we're in a wait and see mode...for what?....good question ...as recent geopolitical and domestic policy actions seems to have left the markets unfazed.

Monday, May 8, 2017

M6 Market Outlook and Ponzo Updates....05.08.17

Both vested M6 positions were modest losers today and only the M6 mean reversionn model is vested for Tuesday....as shown below.

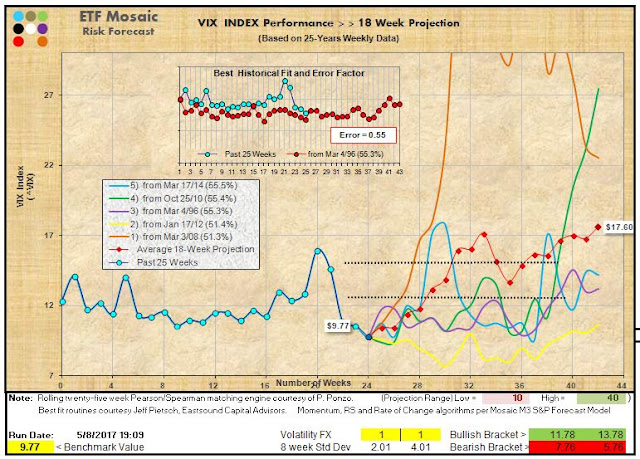

The current Ponzo updates aren't all that divergent...except for the VIX outlook...which is downright scary and reflects a complete collapse of our current abnormal low volatility VIX readings...,<10.

.

The current Ponzo updates aren't all that divergent...except for the VIX outlook...which is downright scary and reflects a complete collapse of our current abnormal low volatility VIX readings...,<10.

.

Saturday, May 6, 2017

M6 Monday Market Outlook and More....05.06.17

Monday's market action will undoubtedly be a response to the French election on Sunday with no clear winner odds despite the French suppression of hacked emails which might likely sway the outcome. M6 is taking a risk on approach in both models for Monday contrary to the currently bullish Trader's Outlook .

I've also attached a few files from the latest State Street Advisors' monthly chart pack .... the last one suggesting this level of volatility complacency is due for breakout.

I've also attached a few files from the latest State Street Advisors' monthly chart pack .... the last one suggesting this level of volatility complacency is due for breakout.

Thursday, May 4, 2017

M6 Friday Market Outlook...05.04.17

Another STOPPED day going into Friday in both models. So far the M6 risk pivot risk filter has done a great job of keeping us from drawdown days. This has held true even though opening market dynamics appear to contradict the M6 odds and then fall into sync with the signal by the time the close rolls around.

Despite the House passage today of OBC repeal the effect on the markets may be negligible.

The French election on Sunday will be the catalyst for next week's action and we're still expecting risk off selling into Friday,s close.

Despite the House passage today of OBC repeal the effect on the markets may be negligible.

The French election on Sunday will be the catalyst for next week's action and we're still expecting risk off selling into Friday,s close.

Wednesday, May 3, 2017

M6 Thursday Market Outlook....05.03.17

Following some sell on the news distributions today the odds are to the downside and both the momentum and mean reversion models are in STOPPED positions. AGG looks enticing but a vesting at this technical juncture is a leap of faith. FB earnings come out after the close which may change the mood in the morning but expect selling into Friday's close as the French election is Sunday and Le Pen is surging in the polls with expected market consequences completely up in the air.

Tuesday, May 2, 2017

M6 Wednesday Market Outlook....05.02.17

M6 was able to register 2 new winners today with QQQ and XLU despite our concerns for the STOP alert rolling over in both mode models.

Today's closing signals are in stopped positions and that may be likely considered APPLE's miss after the close.

Keep in mind all M6 signals are generated based 100% on technical analysis algorithms with no regard to news, earnings, the FED, Kim Jong-on or any other non technical persons, factors or events.

Today's closing signals are in stopped positions and that may be likely considered APPLE's miss after the close.

Keep in mind all M6 signals are generated based 100% on technical analysis algorithms with no regard to news, earnings, the FED, Kim Jong-on or any other non technical persons, factors or events.

Monday, May 1, 2017

M6 Tuesday Market Outlook....05.01.17

Markets kick off May with one Hell of a rally with QQQ on steroids, making the M6 picks for today BIGLEY winners.. That's 10 signals in a row that have accurately predicted a favorable risk/reward outlook. Of particular note in this devil may care risk on trading environment...the VIX swung into the 9s today....the first time since 2007....that's right 2007.

For tomorrow the Qs and XLU are our vested positions although the STOP alerts have turned down in both modes and vested positions are in danger of being stopped out.

Note: AMD missed in after hours taking it down almost 10% but FB reports on the 3rd....with great expectations.

For tomorrow the Qs and XLU are our vested positions although the STOP alerts have turned down in both modes and vested positions are in danger of being stopped out.

Note: AMD missed in after hours taking it down almost 10% but FB reports on the 3rd....with great expectations.

Subscribe to:

Posts (Atom)