Yesterday's post on the T /T delta neutral model was timely as we saw a nice gain today with a picture perfect example of the delta neutral model in action. We handily made up for our little stop loss on Wednesday and gained a bit of traction today to boot. For now the technical signals all look favorable for further gains but the beauty of the DN model is that even if things reverse we will most likely still see capital appreciation. Friday's have been bullish lately (with a possible modest selloff into the close) so a trailing stop is advisable.

Thursday, July 11, 2019

Wednesday, July 10, 2019

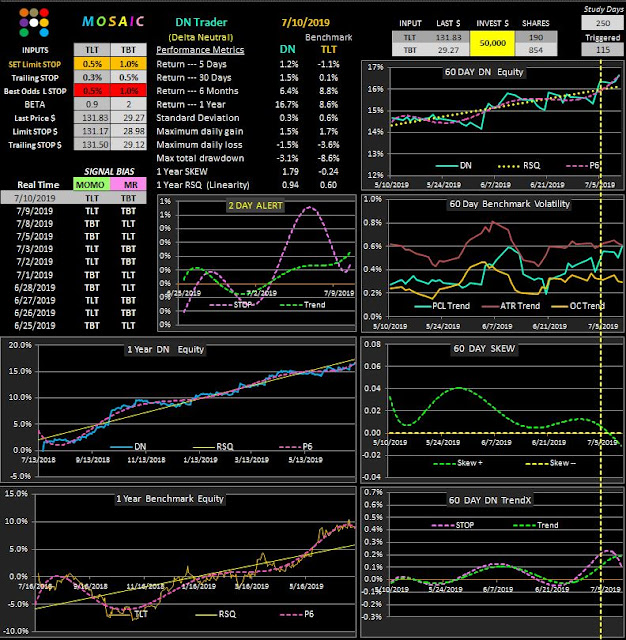

The Low Risk TLT Delta Neutral model Update.....07.10.2019

Our caution about the FED day conflict with the long VXX signal turned out to be well founded and we were able to close our small position at the indicated limit stop, saving us a potential $.30 loss beyond our stop. Below is an update of the TLT / TBT 20 year Treasuries model. It doesn't scream returns like VXX and QLD but it plugs along in a nice, predictable and consistent pattern with great linearity and very low risk. As we mentioned before the TBT (TLT inverse) actually is an ultra short ETF meaning its beta is 2 so we have to adjust our limit stop accordingly.

Note thaat the model only triggered 115 out of 259 trading days...another nice risk feature.

Note thaat the model only triggered 115 out of 259 trading days...another nice risk feature.

Tuesday, July 9, 2019

Scalping the VXX... 2 Strategies.......07.09.2019

Following this weekend's post here are 2 similar approaches to trading the VXX volatility ETN.

In the first case we use the PVOL momentum model which combines momentum as measured by price action of the pivot combined with a confirmation signal that the ATR is in a descending pattern.

The second model TFATR1 ignores price action and focuses solely on the behavior of the ATR metrics. As might be expected the combo PVOL model requiring a confirmation signal has a lower net drawdown and a lower net return over our 1 year lookback. The less discriminate TFATR1 model kicks out a better return at the cost of increased risk exposure. TFATR1 also trades 20% more frequently and has a better win/loss ratio than the combo model. That's the tradeoff.

Both models are long VXX for tomorrow....but keep in mind Wednesday is FED day and the historical odds favor a negative VXX behavior 72% of the time so longs should be ready to bail if things turn ugly. Observe the limit stop.

In the first case we use the PVOL momentum model which combines momentum as measured by price action of the pivot combined with a confirmation signal that the ATR is in a descending pattern.

The second model TFATR1 ignores price action and focuses solely on the behavior of the ATR metrics. As might be expected the combo PVOL model requiring a confirmation signal has a lower net drawdown and a lower net return over our 1 year lookback. The less discriminate TFATR1 model kicks out a better return at the cost of increased risk exposure. TFATR1 also trades 20% more frequently and has a better win/loss ratio than the combo model. That's the tradeoff.

Both models are long VXX for tomorrow....but keep in mind Wednesday is FED day and the historical odds favor a negative VXX behavior 72% of the time so longs should be ready to bail if things turn ugly. Observe the limit stop.

Sunday, July 7, 2019

Model Updates with Various Strategies......07.07.2019

Going forward into the second half of the year the general consensus is that things may get a bit rough as earnings expectations and guidance are down, auto sale are terrible, home sales are stagnant and the political environment is explosive, to say the least. Here then are some examples of how our diversified risk managed portfolio has fared so far.

First, the benchmark default delta neutral model has lagged the last six months.

While the momentum based VIXEN (based solely on volatility, not price) has done well with a rather amazing 95% linearity and a much happier drawdown than the benchmark buy and hold QLD..

Then there's our old friend VXX, the VIX proxy ETN that has come back like a zombie from it former depise and replacement by VXXB only to be reincarnated again as VXX. I still consider this the greatest trade of all time when I advised shorting this guaranteed loser when it was at 900.

We're using the VIXEN momentum model with this toad and the results are actually quite good.

Finally, my hands down favorite low risk no brainer easy money trade. The risk adjusted SPY proxy ETF SPLV using our MR3 (3 day pullback) mean reversion model has a drawdown and win/loss ratio that should make this little nugget of trading gold part of every portfolio...IMHO.

First, the benchmark default delta neutral model has lagged the last six months.

While the momentum based VIXEN (based solely on volatility, not price) has done well with a rather amazing 95% linearity and a much happier drawdown than the benchmark buy and hold QLD..

Then there's our old friend VXX, the VIX proxy ETN that has come back like a zombie from it former depise and replacement by VXXB only to be reincarnated again as VXX. I still consider this the greatest trade of all time when I advised shorting this guaranteed loser when it was at 900.

We're using the VIXEN momentum model with this toad and the results are actually quite good.

Finally, my hands down favorite low risk no brainer easy money trade. The risk adjusted SPY proxy ETF SPLV using our MR3 (3 day pullback) mean reversion model has a drawdown and win/loss ratio that should make this little nugget of trading gold part of every portfolio...IMHO.

Sunday, June 30, 2019

Delta Neutral Update and MoDX for Silver and QQQ..........06.30.2019

Momentum's on a rise and volatility is on a fade. Our "best odds" risk stop has once again retreated to almost 1.0, abou half of where we would expect it to be. Nevertheless, we're continuing to bank coin with the low risk QLD/QID model and I've arbitrarily set the stop limit at 1.4% in anticipation of a Chinese trade news item (which has already been debunked as of 7 PM EST.

The 2 attached MoDX charts are for the Qs and silver...one of my favorite short term options ETFs.

The 2 attached MoDX charts are for the Qs and silver...one of my favorite short term options ETFs.

Monday, June 24, 2019

PONZO Update for SPY....06.24.2019

With so much bearishness in the air from the usual talking heads I thought I better run the latest SPY forecast using the PONZO charts. The outlook via PONZO is NOT bearish although the crap can hit the fan at any time especially if IRAN gets squirrely or if China decides to go mano to mano.

meanwhile the PONZO gold forecast fro just a few weeks ago has proven to be right on although a bit reserved as GLD has already hit the 132 target several months ahead of schedule and its probably best to look for some pullback on that one before initiating any new positions..

See PONZO link at the right side if unfamiliar with our benchmark forecasting tool.

meanwhile the PONZO gold forecast fro just a few weeks ago has proven to be right on although a bit reserved as GLD has already hit the 132 target several months ahead of schedule and its probably best to look for some pullback on that one before initiating any new positions..

See PONZO link at the right side if unfamiliar with our benchmark forecasting tool.

Saturday, June 15, 2019

PONZO Forecasts for Gold and Silver....06.15.2019

Following a number of high profile bullish forecasts for gold in the upcoming months I thouhgt it might be instructive to look at the PONZO charts for both gold (GLD) and silver (SLV), since silver tends to follow gold's momentum and can often be used as a confirmation signal, albeit it a lagging one. The mot recent PONZO forecast for gold was dead on so let's see how this one pan's out.

Per PONZO gold looks a bit overbought right now but the long term prospects for both gold and silver look positive. So.....buy the dip?

Per PONZO gold looks a bit overbought right now but the long term prospects for both gold and silver look positive. So.....buy the dip?

Wednesday, May 29, 2019

Delta Neutral Update....05.29.2019

Here's a look at the current QLD/QID delta neutral model. Note that we've set the trigger threshold up to 2%...reflecting the current pop in volatility. We've missed a few big move days due to the out of the gate surge limit stops...meaning the model simply didn't trigger on those days.

Nevertheless....capital preservation is our number one goal and in that respect the DN model has performed well and shown admirable performance and safety relative to a straight directional model such as our benchmark VIXEN momentum model shown below.

Nevertheless....capital preservation is our number one goal and in that respect the DN model has performed well and shown admirable performance and safety relative to a straight directional model such as our benchmark VIXEN momentum model shown below.

Monday, May 27, 2019

MoDX charts for QQQ and GLD.....05.27.2019

Here are a couple updates for the MoDX (directional momentum DMI+/ DMI-) charts using QQQ and GLD (gold ETF) for illustration. GLD is pretty much a train wreck having gone basically nowhere as the talking heads have screamed BUY!!!! over the last year. QQQ (NAZ100) on the other hand is oversold but as we have (painfully) learned in the past, thing that are oversold can often get even more oversold.

These are 30 day charts since my trading bias is strictly short term.

These are 30 day charts since my trading bias is strictly short term.

Wednesday, May 22, 2019

Delta Neutral Update....05.22.2019

With volatility on the uptick we are once again mining some nice gains in the delta neutral QQQ based model using QLD and its inverse QID. The model produced little return in Aprils due to depressed volatility but since MAY 6th we've seen a sizable bump. Patience is the name of the game when playing delta neutral along with attention to the rules that demand a quick position exit if intraday reversals trigger...of which we've seen several in May.

Note that our optimized limit stop % has risen to 2.6%.. a massive jump from April when it was riding at a sleepy .8%....an all time low.

Both the Skew and the TrendX charts gave us a clear signal back on May 6th that things were about to change.

Note that our optimized limit stop % has risen to 2.6%.. a massive jump from April when it was riding at a sleepy .8%....an all time low.

Both the Skew and the TrendX charts gave us a clear signal back on May 6th that things were about to change.

Sunday, April 28, 2019

PONZO Updates for SPY and QQQ....04.28.2019

The new PONZO updates reflect an almost neutral short term outlook for the broader market. The previous updates almost 6 weeks ago were dead on for PSY and QQQ but wrong for TLT which has shown considerable resilience in the face of the current bullish trend.....which is cautionary.

Best bets now are for some butterfly action although we are still id-earnings season so may be more prudent to wait a couple weeks before going too heavy...or simply scale it.

Best bets now are for some butterfly action although we are still id-earnings season so may be more prudent to wait a couple weeks before going too heavy...or simply scale it.

Thursday, April 25, 2019

Delta Neutral Update 04.25.2019

We haven't posted DN results for a while because we are in one of those extended lull periods where volatility has leveled off and intraday reversals are common. Those are tough times to trade as we get stopped out of positions on a regular basis as opening gaps up or down get reversed during the course of the day so that the other side of the DN trade gets stopped out and we're left with little gains and often small losses as our trailing stops trigger. What's interesting right now is that volatility appears to be on the upswing and if that happens with a vengeance then we'll be back in the money making mode. For now we just play it one day at a time and enjoy the longer term gains.

Saturday, March 23, 2019

Delta Neutral Hits a Home Run....03.23.2019

A great couple days for the delta neutral models QLD/QID and SCHB/SH. Friday was as picture perfect a delta neutral day as could be imagined. A slow start out of the gate gradually built momentum throughout the day as we were limit stopped out of QLD and SCHB and then reaped some nice gains in QID and SH into the close as S3 pivot support levels held firm. So, if we can make the big money with the Qs model why even bother with the S&P based SCHB/SH model?

the answer is that SPY and QQQ do sometimes diverge and the SCHB/SH model is a nice safe jumping off point for traders still trying the understand the delta neutral strategy while still outperforming a SPY based directional trade and with reduced drawdown risk.

the answer is that SPY and QQQ do sometimes diverge and the SCHB/SH model is a nice safe jumping off point for traders still trying the understand the delta neutral strategy while still outperforming a SPY based directional trade and with reduced drawdown risk.

Monday, March 11, 2019

Delta Neutral Update ....03.11.2019

A good day for the QLD/QID delta neutral setup. Markets reversed from Sunday night's red open to a Monday morning blowout for the NAZ. The DOW was held back by a 13% swoon in Boeing stock but the Qs were the momentum leaders from the open to the close.

Note that the "best odds" value for QLD has fallen to a new multiyear low of 1.1...completely contradicting its beta value of 2.

Note that the "best odds" value for QLD has fallen to a new multiyear low of 1.1...completely contradicting its beta value of 2.

Saturday, March 2, 2019

PONZO Updates for March....02.02.2019

Here are the PONZO forecasts for SPY, QQQ and TLT...our major focus indices. The outlook has actually changed significantly since our last look with the SPY and QQQ decidedly bullish and TLT decidedly bearish. Fixed income has been faltering recently and the forecast for TLT suggests that continued weakness is the likely path.

The talking heads are screaming "CASH" with a warning that mid March will see a new opening for the bears. Actually...nobody knows and the motives of the prognosticators are always suspect since no one ever fesses up when they make a lousy call. That's why we trade strictly data driven strategies based on volatility and mean reversion triggers. Recent economic data has been weak with retail suffering major hits but the trickle down effect has not yet set it. When it does...watch out below.

The talking heads are screaming "CASH" with a warning that mid March will see a new opening for the bears. Actually...nobody knows and the motives of the prognosticators are always suspect since no one ever fesses up when they make a lousy call. That's why we trade strictly data driven strategies based on volatility and mean reversion triggers. Recent economic data has been weak with retail suffering major hits but the trickle down effect has not yet set it. When it does...watch out below.

Monday, February 25, 2019

Delta Neutral Update...4 year returns......02.25.2019

I've edited the performance metrics a bit to reflect 4 year results. This system works best in periods of volatility as can be seen by the varying slope of the DN equity curve over 4 years. Low volatility equals flat performance....which can extend for months...but when volatility kicks in we start to mint money with little of the risk exposure that a directionally biased move would create.

The volatility trigger (SET LIMIT STOP) has been set at 1.9%... a value that can fluctuate significantly depending on the current volatility environment. During the course of the past couple years we've seen the BEST ODDS LIMIT STOP range from a high of 3.8 to a low of 1.0 ...close to the current level. If we adjust the SET LIMIT STOP value lower we generate more trade triggers, greater returns BUT a greater risk of reversal drawdowns.......that;s just the tradeoff inherent in using this methodology. For now we'll stick with 1.9% in anticipation of a volatility pop and a big payday.

Note that back on the Feb 5th post of the DN model trades were triggered 169 out of 250 days (68%) while in a longer lookback of 1000 days trades were triggered only 533 or 50% of the time.

The volatility trigger (SET LIMIT STOP) has been set at 1.9%... a value that can fluctuate significantly depending on the current volatility environment. During the course of the past couple years we've seen the BEST ODDS LIMIT STOP range from a high of 3.8 to a low of 1.0 ...close to the current level. If we adjust the SET LIMIT STOP value lower we generate more trade triggers, greater returns BUT a greater risk of reversal drawdowns.......that;s just the tradeoff inherent in using this methodology. For now we'll stick with 1.9% in anticipation of a volatility pop and a big payday.

Note that back on the Feb 5th post of the DN model trades were triggered 169 out of 250 days (68%) while in a longer lookback of 1000 days trades were triggered only 533 or 50% of the time.

Sunday, February 10, 2019

PONZO Updates for SPY, QQQ and TLT....02.10.2019

Here are the February PONZO forecasts for our index targets...SPY, QQQ and TLT.

Comparing the new forecasts to last month suggest a weakening market in both equities and bonds for the next few months. This has been somewhat supported by the generally weak tone and forward guidance of recent earnings reports, especially in some of the big tech names. Industrials are also under pressure while the FED remains the 800 pound gorilla in the bond/treasury market.

Comparing the new forecasts to last month suggest a weakening market in both equities and bonds for the next few months. This has been somewhat supported by the generally weak tone and forward guidance of recent earnings reports, especially in some of the big tech names. Industrials are also under pressure while the FED remains the 800 pound gorilla in the bond/treasury market.

Tuesday, February 5, 2019

Delta Neutral S&P model with Schwab inputs....02.05.2019

Here's a way for Schwab users to trade an S&P based DN model and only incur modest commission fees as SCHB (the SPY ETF proxy in Schwab) trades commission free. Schwab doesn't have an SH proxy (the inverse for SPY) so for now we still have to use the ProShares ETF.

Performance metrics of this model precisely match those of a SPY/SH pairing so save a few bucks and use this version instead. Max drawdown is extremely low compared to the benchmark.

Performance metrics of this model precisely match those of a SPY/SH pairing so save a few bucks and use this version instead. Max drawdown is extremely low compared to the benchmark.

Sunday, February 3, 2019

Delta Neutral Update for QLD/QID and a dollar/euro pair study

As mentioned previously, the recent decline in volatile as reflected in the ATR and OC spreads has limited our delta neutral equity curve. We can get back in the game by simply lowering the limit stop per our "best odds" value and, really, the only risk we incur is opportunity costs when the market opens above/below our limit stop and the trades never get triggered. For now we'll hedge our bets a bit and stick with a slightly elevated limit stop value as compared to the "best odds'.

Also, see below, an update to our classic dollar/euro pair trade using the Z-score analytics.

This is not strictly an either/or trading model...we just look for which side of the trade has the greatest probability of reversing and assume (generally correctly) that the the other side of the pair will react inversely. Pretty good odds on this model with a lookback of 6 months we've had 23 trades, 18 of which have been winners. so a 18/5 win/loss with only minimal drawdown.

Click on chart to enlarge.

.

Also, see below, an update to our classic dollar/euro pair trade using the Z-score analytics.

This is not strictly an either/or trading model...we just look for which side of the trade has the greatest probability of reversing and assume (generally correctly) that the the other side of the pair will react inversely. Pretty good odds on this model with a lookback of 6 months we've had 23 trades, 18 of which have been winners. so a 18/5 win/loss with only minimal drawdown.

Click on chart to enlarge.

.

Tuesday, January 29, 2019

A Delta Neutral 20 Year Treasury model...01.29.2019

Looking to increase our toolbox of DN models in order to diversify income possibilities ....here's the TLT versus TBT model. Keep in mind TBT is leveraged 2x inverse to TLT so the limit stop has to be double TLT and the trailing stop also has to be double TLT's. The linearity of this model is truly outstanding and the overall max continuous drawdown is also attractive...especially when you consider the equity curve of the benchmark TLT when seen in a buy and hold situation.

Sunday, January 27, 2019

Update for Delta Neutral....01.27.2019

Returns have flattened out on the QLD/QID delta neutral model as volatility has followed a decline.

It's still my go to model in this environment of uncertainty and now earnings season is kicking off so expect some sparks. Just for comparison I've included the metrics for a 1 beta DN model trading SPY against SH (the ETF SPY inverse). Again, this mode has a value of 1 beta while the QLD/QID model has a beta value of 2.

It's still my go to model in this environment of uncertainty and now earnings season is kicking off so expect some sparks. Just for comparison I've included the metrics for a 1 beta DN model trading SPY against SH (the ETF SPY inverse). Again, this mode has a value of 1 beta while the QLD/QID model has a beta value of 2.

Tuesday, January 22, 2019

PONZO Update for TLT and an XLU butterfly....01.22.2019

Here is the last of our PONZO toolkit...TLT...the 20 year Treasury long ETF and another of our favorite butterfly plays.

As mentioned yesterday a possible XLU butterfly debit setup is shown below. As with most butterfly trades risk is limited and little trade maintenance is required. This is a 3 week trade with nice odds unless the market really tanks....always a distinct possibility in this volatile environment.

As mentioned yesterday a possible XLU butterfly debit setup is shown below. As with most butterfly trades risk is limited and little trade maintenance is required. This is a 3 week trade with nice odds unless the market really tanks....always a distinct possibility in this volatile environment.

Monday, January 21, 2019

PONZO Updates for XLF and XLU....01.21.2019

Following last week's PONZO forecasts here are the last 2 sector ETFs we will be tracking for a while...XLF (financials) and XLU (utilities). XLF has been hot for the last week but PONZO suggests a cautious or hedged position near term. On the other hand XLU looks especially promising for butterfly traders ....a strategy that has been a consistent money maker over the last 2 years.

Tomorrow we'll look at a couple XLU butterfly setups.....credit and debit....using our PONZO generated support /resistance bands.

Tomorrow we'll look at a couple XLU butterfly setups.....credit and debit....using our PONZO generated support /resistance bands.

Thursday, January 17, 2019

PONZO Updates for SLV, GLD and XOM....01.17.2019

Following yesterday's SPY/QQQ forecasts here are the forecasts for silver, gold and oil (via XOM).

A few high profile names came out today with rosy prospects for gold this year and the PONZO chart certainly supports this. If looking for a safety net GLD looks to be a better bet than SLV (right now) while global economic slowdowns may sustain the current neutral outlook for oil.

Tomorrow ...the financials and utilities via XLU ...my favorite butterfly play.

A few high profile names came out today with rosy prospects for gold this year and the PONZO chart certainly supports this. If looking for a safety net GLD looks to be a better bet than SLV (right now) while global economic slowdowns may sustain the current neutral outlook for oil.

Tomorrow ...the financials and utilities via XLU ...my favorite butterfly play.

Wednesday, January 16, 2019

PONZO Updates for SPY and QQQ......01.16.2019

Here are the new Ponzo Updates for SPY and QQQ. These forecasts have been eerily correct over the past couple years and mostly these are reserved for commercial clients. Ponzo was one of the very few forecasting models that predicted Amazon's streak from $1000 to 1850 along a defined growth path.

See PONZO explanatory link in the right side panel.

Tomorrow we'll look at a few other PONZO models that might help shed light on the possible decoupling of the SPY and QQQ over the next few months.

See PONZO explanatory link in the right side panel.

Tomorrow we'll look at a few other PONZO models that might help shed light on the possible decoupling of the SPY and QQQ over the next few months.

Sunday, January 13, 2019

Delta Neutral Update and Momo vs MR for QLD

The market's been in a bit of a funk last week so we didn't get any trade triggers. Vol may pick up this week if POTUS goes for the Emergency funding option and Dems go ballistic. Well see.

As an aside here also are the QLD performance metrics for our VIXEN TF (volatility momentum) and VIXEN MR (volatility mean reversion) models. It's more than surprising to me that the metrics aren't all that different....you just have to pick one or the other....or go the safe route and play DN.

Always keep in mind that the VIXEN models are NOT based on price parameters but are based solely on daily volatility analyzed using a toolbox of range algorithms.

As an aside here also are the QLD performance metrics for our VIXEN TF (volatility momentum) and VIXEN MR (volatility mean reversion) models. It's more than surprising to me that the metrics aren't all that different....you just have to pick one or the other....or go the safe route and play DN.

Always keep in mind that the VIXEN models are NOT based on price parameters but are based solely on daily volatility analyzed using a toolbox of range algorithms.

Subscribe to:

Posts (Atom)