While the forecasts for SPY and QQQ look extremely similar to last week's outlooks the forecast for TLT has changed dramatically, with outlier scenarios well beyond the 2 standard deviation range. In addition, the consensus forecast has become considerably more constrained than in the previous 2 months....a significant reversals from the consistently bullish outlook seen since TLT bottomed out at 117. This outlook contrasts the the current downward yield curve trend, which nominally would suggest further upside potential for TLT.

Monday, June 26, 2017

Monday, June 19, 2017

Ponzo Updates for SPY, QQQ and TLT.....06.19.17

This week's Ponzo forecasts maintain the bullish theme of the past month. In fact, we're seeing new forecast highs for QQQ and TLT and a slightly reduced target for SPY. Given the market's current view that any news is good news those forecasts have strong odds...with the caveat that North Korea, some wacked out assassin, or any number of other imponderables could quickly lead to a liquidity draining plunge down 7-10%.

Monday, June 12, 2017

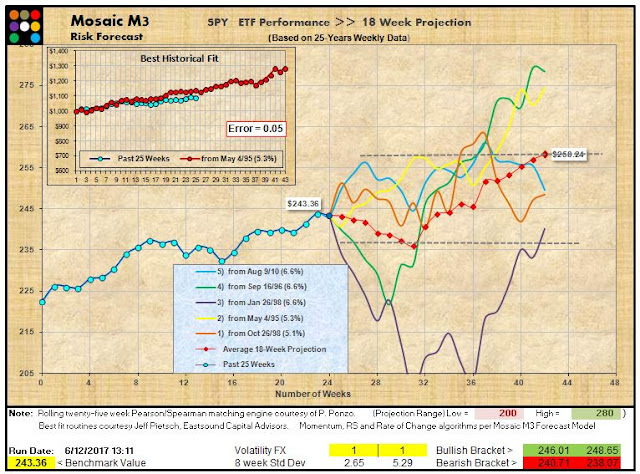

Ponzo Updates for SPY, QQQ & TLT....06.12.17

With an impending yield curve reversal looming when the FEDs hike next week (100% according to FED fund odds), the scenario for TLT remains bullish while SPY and QQQ look prone to reversals of yet to be determined magnitude. The continuing trickle of economic bad news is eventually going to be seen in the markets as valuations reach extreme levels and the historical summertime doldrums kick in. The VIX continues to behave in a mean reverting manner as we witnessed a 24 year low last week. Trader's Outlook has changed its format and is non-committal this week.

Monday, June 5, 2017

Ponzo Updates for SPY & TLT....06.05.17

Expect volatility to spike as Thursday approaches and Comey speaks to Congress. Meanwhile the markets are at new highs and the slow melt up on piddling volume continues. One of these days the balloon will burst and when that happens expect evaporating liquidity (think spreads) will reveal the absence of buyers. Crazy times as bonds continue on a melt up track with SPY.

Odds are 90% the FED will hike mid June.

Odds are 90% the FED will hike mid June.

Saturday, June 3, 2017

VDX Updates and Trader's Outlook....06.03.17

Good employment numbers drove the markets to new highs on Friday and the general rule of thumb is...don't short new highs.

Trader's Outlook is neutral to modestly bearish....betting on a mean reversion trade.

Looking at the current SPY and TLT VDX charts we see (surprisingly that SPY is not overbought and TLT (on massive volume Friday) continues its bullish run as projected by the recent Ponzo.

Trader's Outlook is neutral to modestly bearish....betting on a mean reversion trade.

Looking at the current SPY and TLT VDX charts we see (surprisingly that SPY is not overbought and TLT (on massive volume Friday) continues its bullish run as projected by the recent Ponzo.

Subscribe to:

Posts (Atom)