TLT still has active MRSI and GS2 Long signals so closing the position based on the DB signal is not a clear choice.

Traders and investors that have been in this game for a while know that what we may be seeing is a little relief rally before a bigger drop in the equities markets. It's happened before..big time.. and those that lived through the late 2008-early 2009 50% decline in the market know this pattern only too well.

Statistically speaking, one of the most reliable short term patterns for swing traders has been 3 wide range days up (or down), a consolidation or marginal rally for a day or two and then a surge forward in the direction of the previous trend. Candlestick traders refer to this market behavior as "3 black crows" and we definitely don't want to be on the wrong side of equity/bond fulcrum if this is what is developing now.

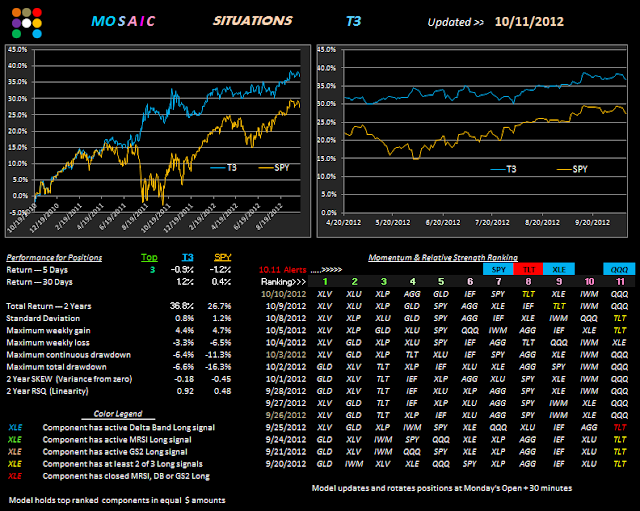

As mentioned in previous posts, this is a time for extreme caution in my opinion. The 2 RM Mosaic models switch to cash has been a good tell for impending market declines in the past and I'm paying close attention to how that active safety net pans out.

These ALERTS are provided to you as a means to help track the performance

of the Mosaic investments models only and are in no way intended as a

solicitation to buy or sell any securities which may be mentioned in

these Alerts.

ETF Mosaic makes no warranty as to the reliability of these trading signals, either actual or implied.