Here's a few more details on the upcoming Ponzo credit spread strategy.

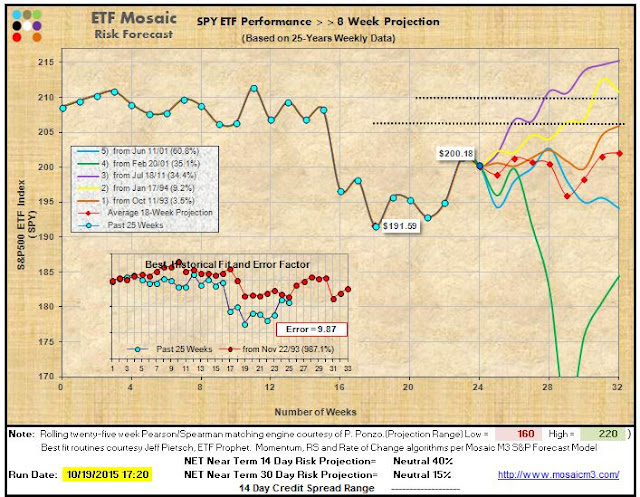

First we check the Monday night weekly update of the SPY Ponzo chart to assess the likely risk profile over the coming 8 weeks, although our attention is really focused on the upcoming 3-4 weeks.

What we're looking for is a consensus signal either up, down or neutral. The stronger the consensus..whether up down or neutral. the better.

Then we set up or down 1 to 2 standard deviations and set a spread bracket. If the trend is down then we sell puts, if the trend is up or neutral then we sell calls...for now these are always credit spreads.

We look for option expiration in 14 to 21 days as this is the period of maximum premium decay and this shortened duration also limits our exposure time.

The example shown below is just that...an example. We can a lot better than this risk/reward trade in actual market conditions

With tomorrow's update of the weekly Ponzo forecast we'll explore a couple potential spread setups using this strategy..