Despite the marginal rally effrots of the past few days the markets are not displaying any momentum trends that can be tracked with our models and CASH is still the P6 indicated position for all models.

A closer look at the X sector model shows it virtually neck and neck with SPY on both a short and long term basis...thereby revealing the lack of momentum in any particular sectors. This is actually an abnormal situation and shows the lack of leadership and commitment of capital in the markets.

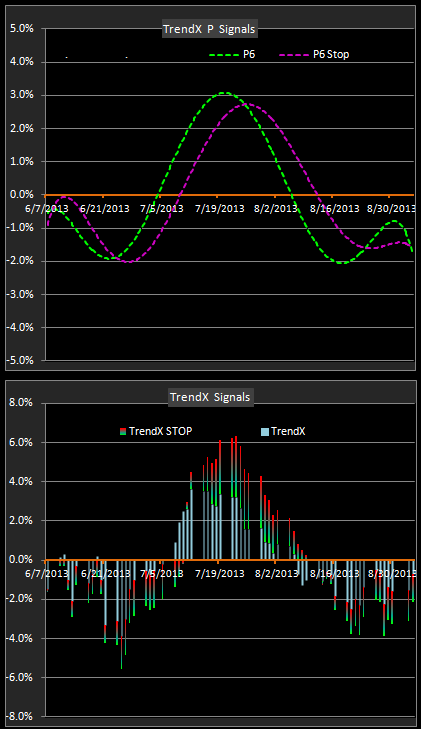

If we take a closer look at what the TrendX signals are showing for this model we are confronted with a distinctly negative view of the current momentum rankings. This doesn't mean the rankings aren't working...what it means is 2 things:

(1). The disparity between momentum strengths in the various components is very slight (no leadership) and

(2) Remaining vested in the model rankings will mean that you will lose money slower than if the rankings had been ignored.