Even if you were a talented fiction writer you couldn't come up with the plot twists we saw over the weekend in the on-going Greek tragic comedy. (see Briefing.com piece at the end of this post).

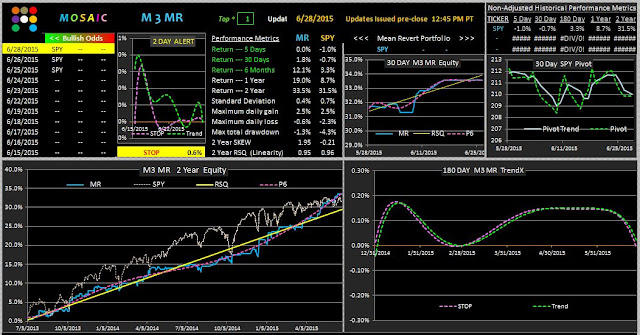

Meanwhile I've been working on a new model than incorporates elements of the 3 day low model and a more true mean version algorithm. We'll be adding this model ...MR...to our daily signal update as it provides a completely different take on market dynamics than the LM and M3, which are momentum and relative strength based. As you may see in the screen shots below the model has a number of permutations. We can simply look at a single equity...such as SPY, or we look at several issues such as SPY, QQQ and IWM to see if there exists a market wide mean reversion dynamic in effect. We'll post a few more variations of MR in the coming days including a long/short version. Once again, our goal is risk mitigation and maximizing the RSQ linearity of the equity curve and MR looks promising in that regard so far.