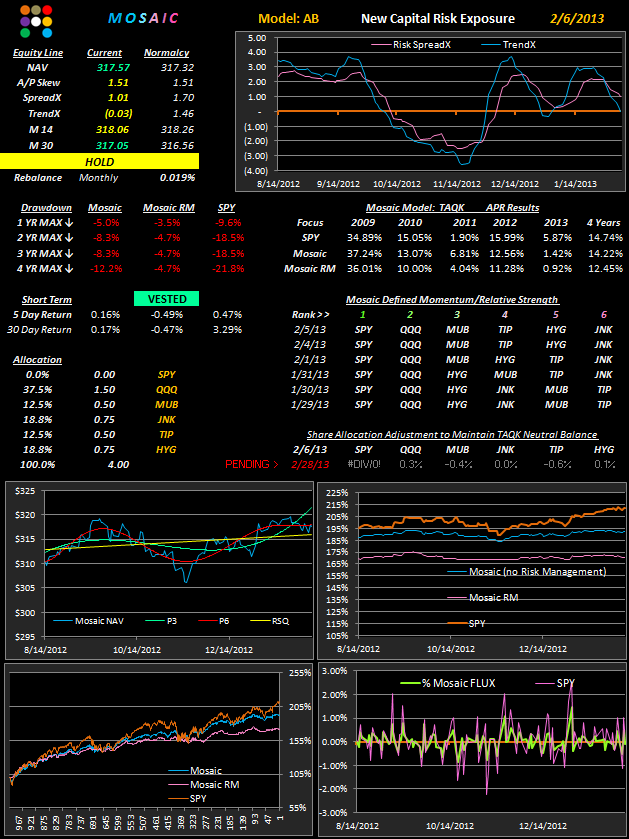

Our tactical allocation models are starting out the year poorly...that's the bottom line. It also supports my belief that, although the models worked well in the past 4 years, this year might be different. Hence my push to refine the T6 methodology in several iterations.

I had a comment yesterday that a simple allocation model would be appreciated and LM and TAQK models were designed with that goal in mind. Going forward however I think low risk capital appreciation may require a more strategic approach. Unfortunately, the crystal ball for 2013 is cloudy...here's one opinion from Seeking Alpha, but there are an equal number that argue for a true bull run this year. Our goal is to prepared for whatever the market gives us and to grow our portfolios with minimal risks.

To accomplish these ends I intend to suggest several ways to use the T2 and T6 software in the coming month. This will vary from the simple to the more complex, but with the software tools in hand you are free to pursue whatever strategy suits your needs and comfort level.

Although the Mosaic path has explored varied trails of capital appreciation over the past 6 months our focus has not changed...a modified market neutral model to temper risk and follow up trending investment instruments. The move to T6 follows that focus and will enable considerably more user control than the LM and AB models, which will also be retired in March since they can be replicated in T6 and tracked on a daily basis without relying on Newsletter postings.