An interesting interview with Kyle Bass this morning on CNBC in which he noted that the technical long/short correlation of stocks and bonds has fallen apart and continues to deteriorate. The practical implication for investors is that the search for superior portfolio components needs to be rethought to include different asset groups that are more focused on true capital appreciation potential. This is a huge subject and we'll touch on some possible areas of exploration in future posts.

Here are updates on 3 T2 models that have been profiled previously:

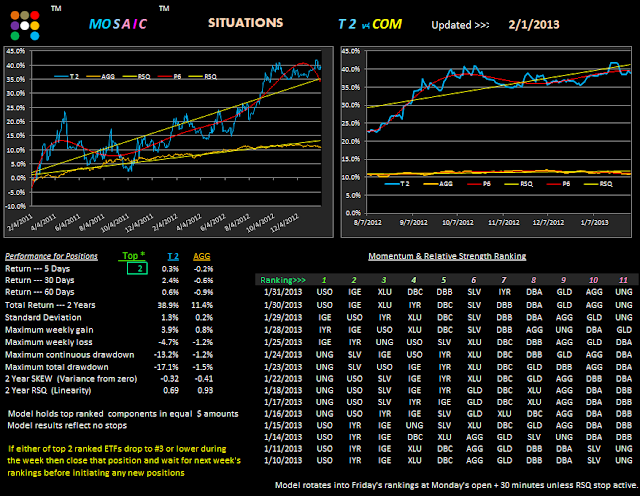

COM: a commodity based model

(note the COM benchmark is AGG (bonds) just to avoid SPY as a viable component)

SA: a model comprised of top ranked stocks from Seeking Alpha

WS: a model comprised of top ranked stocks for 2013 from Wall Street analysts

Note that GE is in the current top 2 slots in both the SA and WS models.

Meanwhile, energy continues to dominate the commodities model. (IGE is a blend of natural resources)