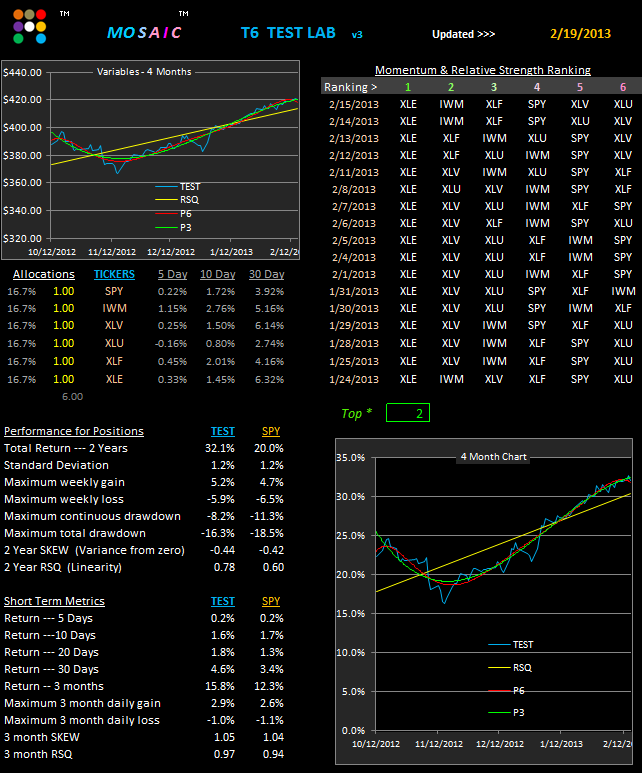

The updated T6 Lab's simple bullish portfolio is still focused on XLE and IWM. As mentioned last week these positions are looking toppy using the P6 and stops should be rigorous enforced.

Of the 6 components XLF now looks like an emerging momentum sector, but the extremely low market volume needs to be considered as well as the possible effects of a debt ceiling collapse.

XLV has been jumping in and out of the number 2 slot recently and here's a fairly detailed analysis of some fundamental issues to consider regarding XLV's reflection of the health care sector.

Over the weekend I made some refinements to the T6 Lab and those updates will be issued as version 3, probably this weekend. With the release of version 3 I don't foresee any further enhancements to the model anytime soon so the tutorial on its use can proceed without having to adjust for new elements in the Lab.

Thanks for bearing with me as these incremental refinements have been added. My goal, as always, is to provide a versatile and adaptable testing environment for model portfolios accompanied by risk controls that are easy to identify and implement.