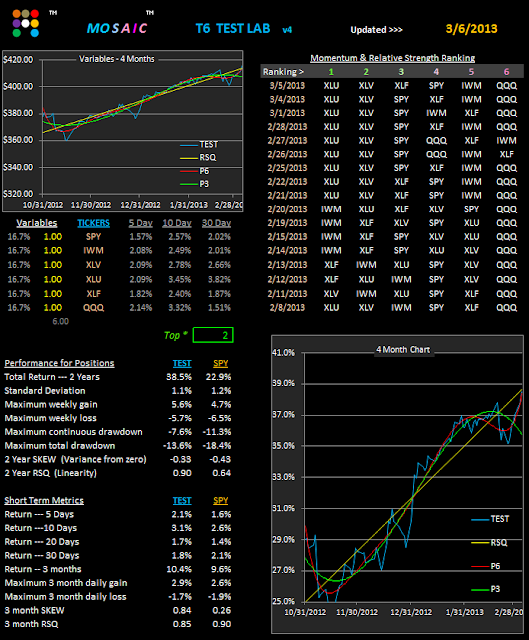

Monday we looked at 2 different portfolios, one with QQQ and one with IWM. Here's another variation using both QQQ and IWM, but this time time deleting XLE (Oil) from the mix. The results may be a bit surprising since XLE was ranked #1 for extended periods during our 2 year lookback in the previous models. Turns out the real issue is volatility, as demonstrated in the resultant metrics in this model without XLE.

Hope you enjoyed that video yesterday. At least they could have adjusted the seat for the kid but I guess in 10 years it will be just the right height for him.

Here's another link, much more mundane. It's the FED's POMO schedule. Shorter term traders are well advised to keep track of the days with big buying...it does make a difference in market dynamics. The schedule automatically updates every month so you can see the potential impact well ahead of time. I ran some studies last year that showed an overnight edge by buying at the close the day before the big days and then selling mid day on the actual buy days. Just something to keep an eye on if the idea intrigues you.