We hit 16000 DOW and 180 on the SPY.....as I suggested last week the markets love whole numbers and these meaningless technical benchmarks are often critical support and resistance levels. That may be the case here as we saw a midday reversal im momentum, although all transpiring in a low volume backdrop.

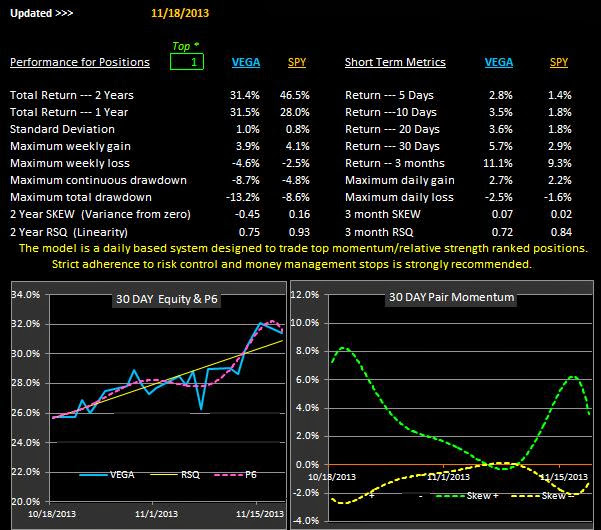

This version of VEGA, without the hyper volatile XIV, and using a top 1 sort has now turned to CASH.

This is the same algorithm as the T6 model so inputting these ETFS should yield the same results.

The new M6 models are still in development based on a recent and major change in the algorithms.

We're seeing a contraction of the % change divergence between SPY and SSO, the SPY ultra bull, and when (and if) the skew converges at the zero line we will be in true bear territory.