The markets are not happy this morning as the advance decline line (NYAD) is crumbling badly.

TLT is finally showing some bottoming action along with gold...both of which are up > .5% as of 2 hours in. A lot of chatter on the low VIX...opening this morning less than 14 and now up over 3% for the day.

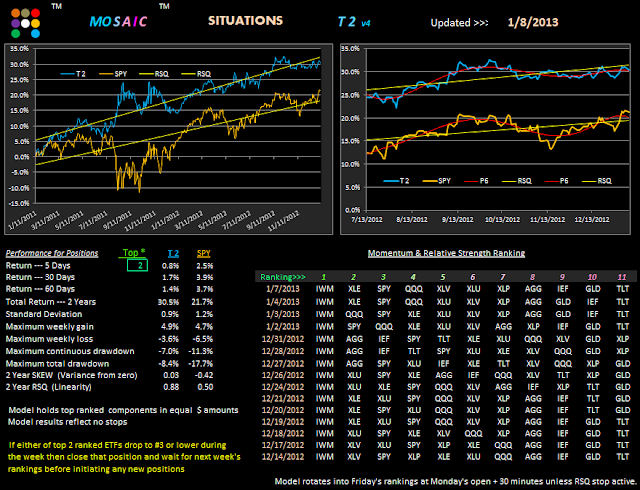

A look at the T2 default model still has IWM in the lead but that XLE second rank is a hold over from last week. The T2 RSQ stop is still in place so all positions should be flat at this point.

A couple readers asked me to run a T2 model focus on the financial sector, which has been on a run up lately. Here's one version for your consideration and the results are not all that encouraging for long term positions. As with the tech and gaming models stops must be closely followed.

Note the volatility chart relative to SPY. If nothing else the component overlay of the charts below should help rationalize the use of XLF as an appropriate proxy for this sector...it evens out the volatility of the "jumpy" price patterns that otherwise follow a very similar pattern. This version shows the results of a top 6 study. Things get even more volatile when smaller top numbers are explored. Based on the above metrics (5 and 30 days) there are some trading advantages using the momentum model but caution is clearly required when the equity curve violates the RSQ and/or P6.