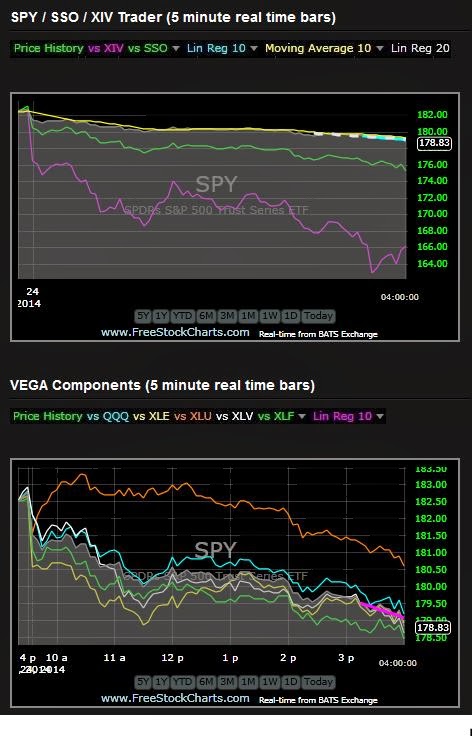

Yesterday's cautionary note proved to be timely. Markets went from bad to worse, closing at the day's lows, with the DOW dropping 318 points to close below 16,000 and SPY below 180.

The VIX actually rose almost 31% today, the highest level in 3 months and the SPY TrendX (right side panel) is now sitting at a major support level.

How bad was it today? It was bad. One of the nifty tools that Schwab has on its EDGE platform is a real time advance/decline ticker for individual stocks and/or ETFs with a +1000 to -1000 scale.

For several 20 minute spans late in the afternoon SPY was reading -1000 in the red...meaning that NOBODY was buying a single share...that's selling as strong as it gets.

It would be reassuring to say the carnage is over but that's not clear at all.

Utilities (XLU) managed to stay in the green until midday when the selling began in earnest. XLU is generally regarded as a safe haven in times of market weakness but if XLU selling continues this will be a omen of more selling to come. Needless to say, M3 is in cash.

I'll be on the road next Monday and Tuesday and there will be no posts for those 2 days.