On a 20 day basis the Schwab model is slightly outperforming SPY, mostly due to a focus on the Schwab housing and foreign stock ETFs (SCHH and SCHF).. The good news...no commissions.

The short term ALERT signaled CASH on the 16th.

This model slight;y underperformed SPY and has been focused on VGK...the Vanguard total Europe ETF...recently superceded by EWG (Germany).

The short term ALERT signaled CASH on the 16th.

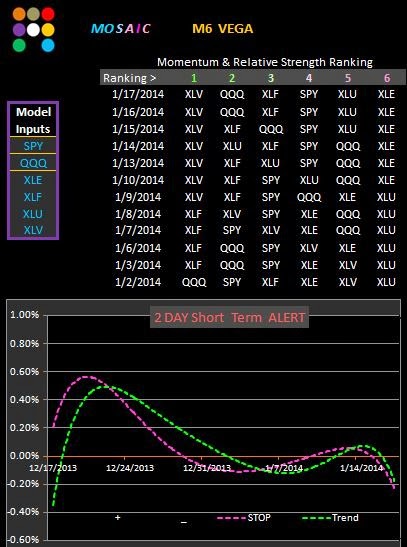

Vega has been the loser of the 3 models, having been in a downswoon since late December if a top 2 sort were used. I'm still analyzing exactly why the momentum and relative strength signals failed to produce a more favorable return but that;s a work in progress.

Had we used a top 6 sort the results look somewhat different but with the clarity of hindsight we can see that simply holding SPY would have achieved the same results..... so why bother?

Can we do better by simply applying strict risk management controls to a SPY position versus the diversified risk of a portfolio model? That's the question M3 was designed to answer.