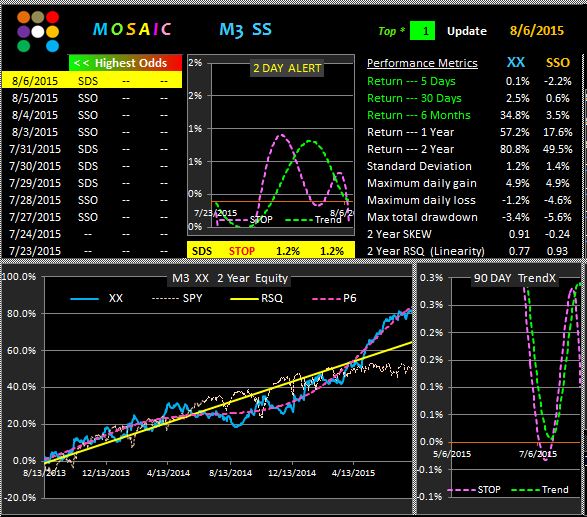

Following yesterday's post on the use of limit stops here's a simple market neutral model (second panel) that you can use with a defined risk and minimal drawdown.

The inputs are SSO and SDS, the leveraged 2x ETFs up and down of SPY...so you get a beta advantage of 2 and the fixed limit stop is 1.2% (twice our normal stop size for the SPY)

As you can see, this strategy pays off handsomely in the long run. You don't need to look at charts, you don't even need a computer, just a line to your broker to place the order at the close of each day. Set it, forget it. Wait till the end of the day and do it again. No sleepless nights here.

The first panel uses SSO and SDS with an optimized mean regression algorithm filter.

The model rotates into the top ranked issue at the end of each day and sets a 1.2% stop.

The second panel buys both positions in equal $ amounts at the end of each day and sets the same 1.2% limit stop for both positions.

In both cases we've used SSO as the benchmark for performance.

Note the differences in linearity and total drawdown.