If there are changes in the model T3 MRSI and DB color signals as of today's close they will be posted by 4pm this afternoon PST.

In future posts the focus will shift to the Lazy Man model and its variations. There's a number of short term and long term opportunities with that model using the Situations momentum rankings and the MRSI / DB signals and we've really just begun to explore them.

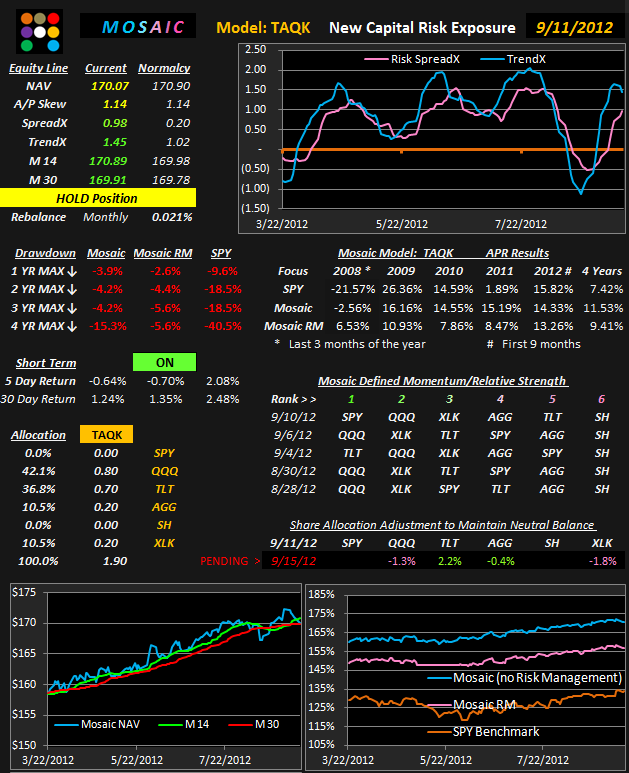

Next month we'll also begin a look at an adaptive version of the model....one that adjusts the position sizes on a weekly or monthly basis, dependent on relative momentum and relative strength in each of the portfolio components.